Public Health Insurance When it comes to health insurance, individuals often face the choice between private and public options. Understanding the differences between these two types of health insurance is crucial for making informed decisions about your healthcare coverage. This article will explore the key features, benefits, and drawbacks of private and public health insurance, helping you determine which option may be best for you and your family.

What is Public Health Insurance?

Public health insurance refers to government-funded programs designed to provide healthcare coverage to specific populations. In the United States, the most notable public health insurance programs include:

- Medicare: A federal program primarily for individuals aged 65 and older, as well as some younger individuals with disabilities. Medicare consists of different parts that cover hospital care (Part A), medical services (Part B), and prescription drugs (Part D).

- Medicaid: A joint federal and state program that provides health coverage to low-income individuals and families. Eligibility varies by state, but Medicaid generally covers a wide range of services, including hospital visits, doctor appointments, and long-term care.

- Children’s Health Insurance Program (CHIP): This program provides health coverage to children in families with incomes too high to qualify for Medicaid but too low to afford private coverage.

What is Private Health Insurance?

Private health insurance is coverage provided by private companies, which can be purchased individually or offered through employers. Private insurance plans can vary widely in terms of coverage, costs, and provider networks. Some common types of private health insurance include:

- Employer-Sponsored Insurance: Many employers offer health insurance as part of their employee benefits package. These plans often cover a significant portion of the premium costs, making them more affordable for employees.

- Individual Plans: Individuals can purchase health insurance directly from private insurers or through health insurance marketplaces established by the Affordable Care Act (ACA). These plans can vary in terms of coverage, premiums, and deductibles.

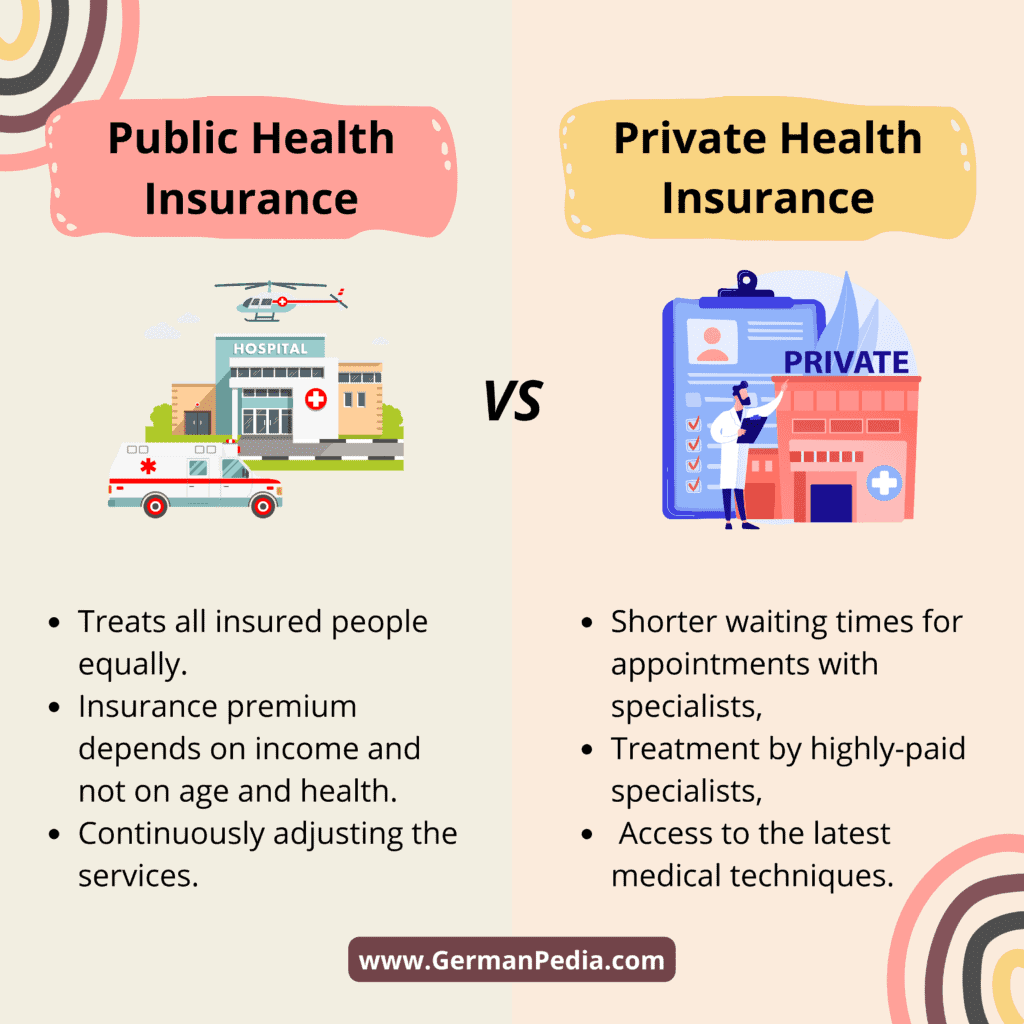

Key Differences Between Private and Public Health Insurance

1. Cost

Public Health Insurance: Public programs like Medicare and Medicaid typically have lower premiums and out-of-pocket costs compared to private insurance. Medicaid, in particular, is designed to provide affordable coverage for low-income individuals and families. However, coverage may vary by state, and some services may require copayments.

Private Health Insurance: Private insurance plans often come with higher premiums, deductibles, and out-of-pocket costs. However, they may offer more flexibility in terms of provider choice and coverage options. Employer-sponsored plans may help offset some costs, but individual plans can be expensive, especially for those with pre-existing conditions.

2. Coverage Options

Public Health Insurance: Public programs generally provide comprehensive coverage, including essential health benefits mandated by the ACA. However, certain services may have limitations or require prior authorization. For example, Medicaid may have restrictions on certain treatments or medications.

Private Health Insurance: Private plans can offer a wider range of coverage options, allowing individuals to choose plans that best fit their needs. Some private plans may include additional benefits, such as dental and vision coverage, wellness programs, and alternative therapies. However, the level of coverage can vary significantly between plans.

3. Provider Networks

Public Health Insurance: Public programs often have a more limited network of providers. For example, Medicaid may require beneficiaries to see specific doctors or specialists within its network. This can limit access to certain healthcare providers, especially in rural areas.

Private Health Insurance: Private insurance plans typically offer a broader network of providers, giving individuals more flexibility in choosing healthcare professionals. However, using out-of-network providers may result in higher costs or reduced coverage.

4. Eligibility and Enrollment

Public Health Insurance: Eligibility for public programs is often based on income, age, or disability status. Enrollment periods may be limited, and individuals must meet specific criteria to qualify. For example, Medicaid eligibility varies by state, and some states have expanded their programs under the ACA.

Private Health Insurance: Individuals can purchase private insurance at any time, although open enrollment periods may apply for plans offered through the ACA marketplace. Employer-sponsored plans typically have specific enrollment periods tied to employment.

5. Quality of Care

Public Health Insurance: Public programs aim to provide essential healthcare services to vulnerable populations. While many beneficiaries receive quality care, some may experience longer wait times for appointments or limited access to specialists due to provider shortages.

Private Health Insurance: Private insurance plans often emphasize customer service and may provide quicker access to care. However, the quality of care can vary depending on the provider network and the specific plan chosen.

Making the Right Choice for You

When deciding between private and public health insurance, consider the following factors:

- Your Healthcare Needs: Assess your family’s healthcare needs, including any chronic conditions, regular doctor visits, and prescription medications. This will help you determine which type of coverage is most suitable.