Receiving a health insurance claim denial can be a frustrating experience, especially when you believe the services you received should be covered. Whether it’s for a medical procedure, prescription medication, or a hospital stay, a denial can leave you feeling helpless, particularly when you’re already dealing with health issues. However, it’s important to know that you have the right to appeal the decision. This article provides a comprehensive guide on how to appeal a health insurance claim denial, ensuring you understand your rights and the steps you need to take.

Understanding Health Insurance Claim Denials

Before diving into the appeal process, it’s essential to understand why health insurance claims are denied. Common reasons for denial include:

- Lack of medical necessity: The insurer may determine that the treatment or service is not medically necessary.

- Out-of-network providers: If you received care from a provider not covered by your plan, the claim may be denied.

- Incomplete information: Missing documentation or incorrect coding can lead to a denial.

- Policy exclusions: Some services may not be covered under your specific health insurance policy.

Understanding the reason for the denial is crucial, as it will guide your appeal strategy.

Step-by-Step Guide to Appealing a Health Insurance Claim Denial

Step 1: Review the Denial Letter

The first step in the appeal process is to carefully review the denial letter from your insurance company. This letter should outline the specific reasons for the denial and provide information on how to appeal. Take note of any deadlines for filing an appeal, as these can vary by insurer and state.

Step 2: Gather Documentation

Collect all relevant documentation related to your claim. This may include:

- The original claim: Keep a copy of the claim that was submitted.

- The denial letter: This will be your primary reference point.

- Medical records: Obtain any medical records that support the necessity of the treatment or service.

- Bills and invoices: Gather all bills related to the denied claim.

- Correspondence: Keep records of any communication with your healthcare provider or insurance company.

Having comprehensive documentation will strengthen your case during the appeal process.

Step 3: Contact Your Insurance Company

Before formally submitting an appeal, consider contacting your insurance company’s customer service department. Sometimes, a simple phone call can clarify the reason for the denial and provide insight into what additional information may be needed. Be sure to take notes during the call, including the name of the representative you spoke with and any reference numbers.

Step 4: Write Your Appeal Letter

If you decide to proceed with the appeal, you will need to write a formal appeal letter. Here are some key components to include:

- Your information: Include your name, address, policy number, and contact information.

- Claim details: Clearly state the claim number and the date of service.

- Reason for appeal: Explain why you believe the claim should be approved. Reference the specific reasons for denial and provide counterarguments supported by your documentation.

- Supporting evidence: Attach copies of relevant documents, such as medical records, bills, and the denial letter.

- Request for reconsideration: Politely request that the insurance company review your claim and reconsider their decision.

Step 5: Submit Your Appeal

Send your appeal letter and supporting documents to the address provided in the denial letter. It’s advisable to send your appeal via certified mail or another trackable method to ensure it is received. Keep copies of everything you send for your records.

Step 6: Follow Up

After submitting your appeal, follow up with your insurance company to confirm that they received your appeal and to inquire about the timeline for a decision. Most insurers are required to respond to appeals within a specific timeframe, typically 30 to 60 days.

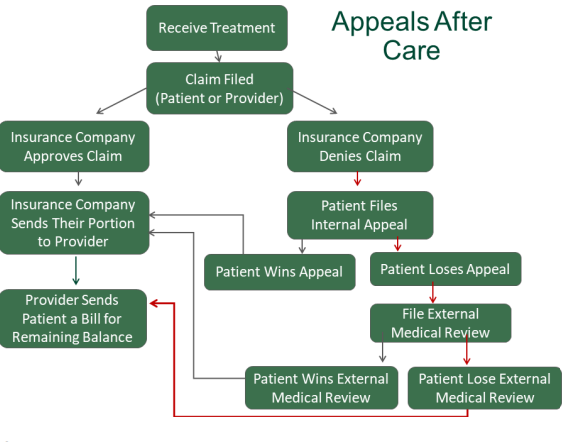

Step 7: Review the Outcome

Once you receive a response to your appeal, carefully review the decision. If your claim is approved, ensure that the payment is processed correctly. If the denial is upheld, the letter should explain the reasons for the continued denial and provide information on further appeal options.

Step 8: Consider Further Action

If your appeal is denied again, you may have additional options:

- Internal appeal: Some insurance companies allow for a second internal appeal. Check your policy for details.

- External review: If your insurer continues to deny your claim, you can request an external review by an independent third party. This process is typically available for claims involving medical necessity and coverage disputes.

- Legal action: As a last resort, you may consider seeking legal advice or pursuing legal action against your insurer, especially if you believe they have violated your rights.

Tips for a Successful Appeal

- Be persistent: The appeals process can be lengthy and frustrating, but persistence is key. Don’t hesitate to follow up and advocate for your rights.

- Stay organized: Keep all documents, correspondence, and notes organized. This will help you present a clear case during the appeal process.

- Seek assistance: If you’re feeling overwhelmed, consider seeking help from a healthcare advocate or legal professional who specializes in health insurance issues.

Conclusion

Appealing a health insurance claim denial can be a challenging process, but understanding your rights and following the appropriate steps can increase your chances of a successful outcome. By carefully reviewing the denial, gathering documentation, and presenting a well-structured appeal, you can advocate for the coverage you deserve. Remember, you are not alone in this process, and there are resources available to help you navigate the complexities of health insurance.